Summary of Key Points

- An excise tax is any tax legislated by a country to goods or services sold for use within its borders.

- Canada’s excise tax on vape products came into effect on October 1, 2022. It was $1 on every 2mL or g of product up to 10 units, plus $1 per 10mL or g thereafter (rounded up to the nearest unit).

- Starting April 1, 2025, the provinces of New Brunswick, Manitoba, Prince Edward Island, Alberta and Yukon will join a federal program where extra taxes are added to vape products. Ontario, Quebec, The Northwest Territories, and Nunavut have already implemented this additional excise tax.

- With the added provincial tax, the excise tax on vape products (e-liquids, disposable vapes, pre-filled pod systems and nic base) will essentially double.

Since 2022, Canada has imposed an excise tax on vaping products imported to or sold in the country and more changes are coming for 2025.

U Vape follows the latest developments in Canada to help you keep purchasing and using the highest-quality vaping products. Our team explains everything you need to know about Canada’s vaping excise tax so you can see how you’re affected.

What Is the Excise Tax?

Excise taxes or excise duties apply to specific goods manufactured within a country or imported for use in that country. This makes them different from tariffs (which apply to imported goods between countries to regulate competition and protect domestic suppliers).

Numerous products are subject to excise taxes in Canada. Excise taxes on the following goods existed in Canada before the tax on vaping products:

- Spirits

- Wine

- Tobacco products

- Cannabis products

Although excise taxes must technically be paid by the manufacturers or importers of the products they apply to, nearly all businesses affected by excise taxes raise their prices to compensate, which means higher consumer prices as well.

The Canada Vaping Excise Tax Explained

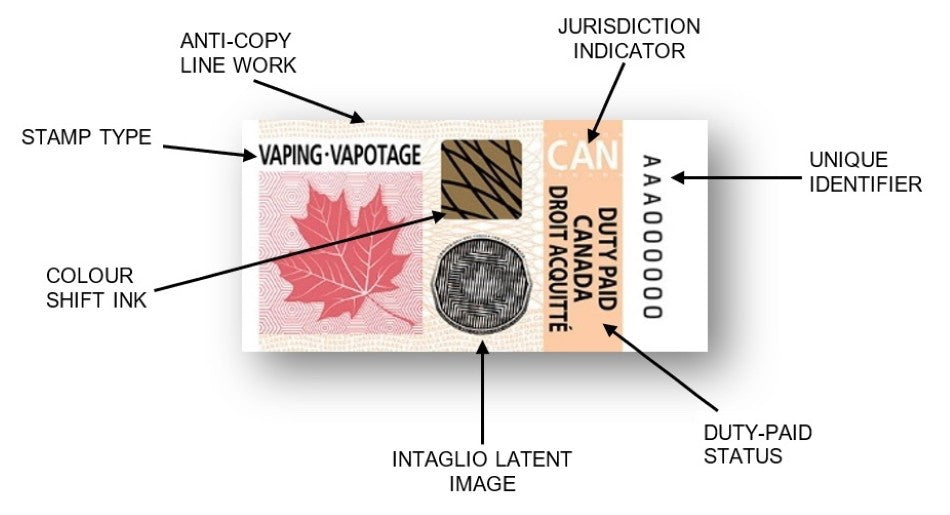

Canada’s excise tax on vaping products requires a duty to be paid on all vaping products intended for use in a vape device in Canada. These goods also require a stamp confirming that the appropriate duties were paid.

The Canada vaping excise tax came into effect on October 1, 2022, with a transition period that ended on December 31, 2022. Since January 1, 2023, buying or selling unstamped products has been illegal.

Additional Vaping Duties Starting April 1, 2025

Effective April 1, 2025, vaping will get more expensive in five Canadian provinces:

- New Brunswick

- Manitoba

- Prince Edward Island

- Alberta

- Yukon

These five provinces are the latest to join a federal program where extra taxes are added to vape products. Vape users will see a regular federal vaping tax plus a provincial tax with their vaping purchases. With this additional tax, the total excise tax on vape products will essentially double.

Several provinces and territories (specifically Ontario, Quebec, Northwest Territories and Nunavut) have been collecting additional tax on these products since July 1, 2024 and will not be affected by these upcoming changes.

Frequently Asked Questions about the Canada Vaping Excise Tax

Many users of vaping products have questions about how the excise tax affects them. We’ve put answers to some of the most common ones below.

How Much Is the Canada Vaping Excise Tax?

As of July 1, 2024, where the initial excise tax had a 12% increase, the excise duty on vaping products in Canada applies as follows:

- $1.12 per 2 mL or g (liquids vs solids) for the first 10 mL or g.

- $1.12 per 10 mL or g for amounts above the initial 10 mL or g.

Amounts are rounded up to the nearest mL or g to calculate the amount of the final duty.

With the updated excise tax coming on April 1, 2025, here’s a breakdown of how the previously mentioned provinces will be affected.

| Size of Container | Excise Tax (2022) | Updated Excise Tax (Effective July 1, 2024) | New Excise Tax (Effective April 1, 2025) |

|---|---|---|---|

| 30mL | $7.00 | $7.84 | $15.68 |

| 60mL | $10.00 | $11.20 | $22.40 |

| 120mL | $14.00 | $15.68 | $31.36 |

| 20mL disposable vape | $6.00 | $6.72 | $13.44 |

Who Pays the Canada Vaping Excise Tax & When?

It depends on whether the product being taxed is made in Canada or imported.

- The duties for vaping products made in Canada must be paid when the product is packaged, by the product licensee (i.e. the party packaging the product).

- For imported products, the duty must be paid at the time of importation by the party liable under the Canada Customs Act. This is usually the owner or importer of the product.

Did the Canada Vaping Excise Tax Make Vaping More Expensive?

Many businesses manufacturing or importing vaping products raised their prices to compensate for the excise tax, passing the costs onto consumers. This has significantly raised the costs of vaping for many customers.

But it’s not all bad news. Remember, if you use cannabis or tobacco products (among others), you’ve almost certainly already been paying for the excise tax on them already. Vaping remains more cost-effective than smoking, although the new excise tax certainly cuts into the amount you save.

Does the Canada Vaping Excise Tax Apply to Devices or Just e-Juice?

The excise tax applies to e-liquid, disposable vapes, pre-filled pod systems, and nic base sold for use in vaping. However, it does not apply to hardware.

That means no price hike for refillable devices that haven’t been pre-filled before being packaged and sold. Many open pod systems have been unaffected.

Learn More about Buying Vape Products in Canada

Understanding the ways that laws and regulations can affect your ability to buy vaping products helps you plan and budget for your devices, e-liquids, and accessories. To learn more or discover our wide range of high-quality vaping products available across Canada, contact UVape and speak with a team member who can answer your questions.